45l tax credit multifamily

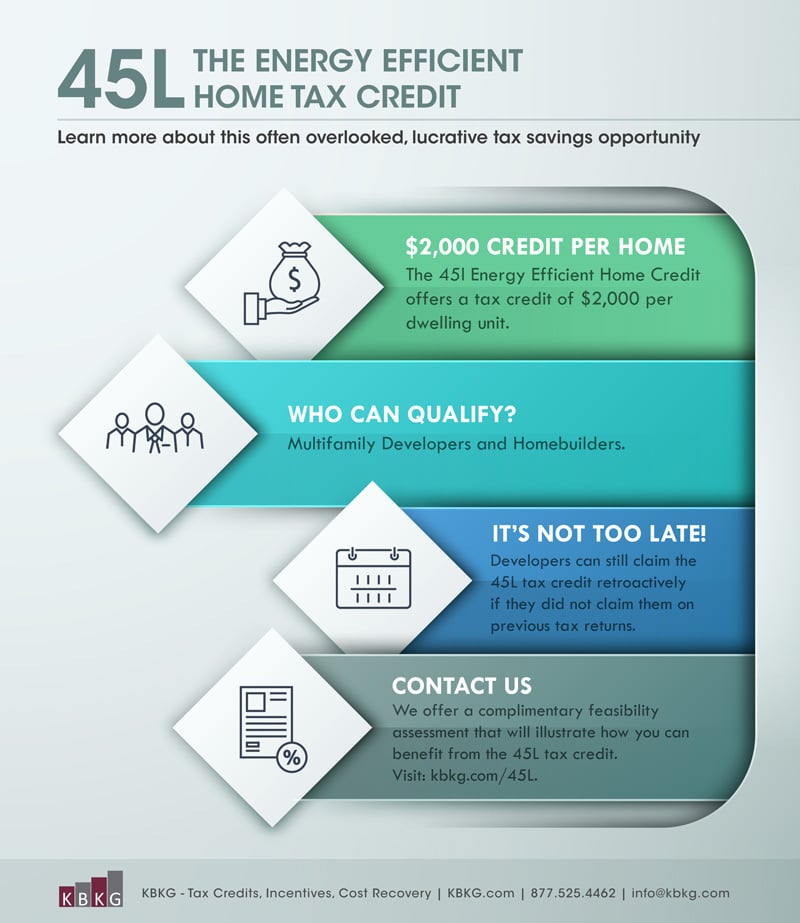

Section 45L is a little-known tax credit that offers developers a means to offset the costs associated with building energy-efficient single family or multifamily properties. 45L is for residential and multi-family properties.

45l Tax Credit Energy Efficient Tax Credit 45l

Each newly contractor built energy efficient residential dwelling purchased from the contractor and used as a residence over the last few years is eligible for.

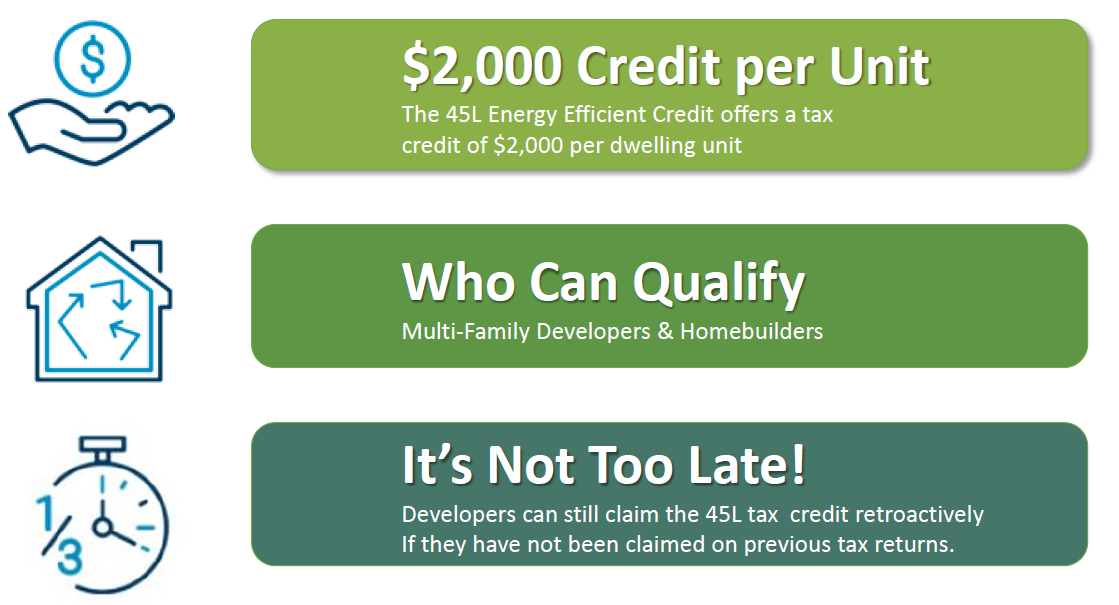

. Single family homebuilders and multifamily. The 45 L Tax Credit program is designed to provide a 2000 per unit Tax Credit for building more energy efficient newly built residential housing or remodeled renovated residences. The Section 45L tax credit had expired at the end of 2011 but this bill extends the tax credit for two years through 2013.

45L tax credit overview. Tax Credit for Energy Efficient Residential Buildings The New Energy Efficient Home Tax Credit Code Section 45L has been extended to December 31 2011. This credit provides a dollar-for-dollar offset against taxes owed or paid in last three years on property sold or leased.

How do you know if your property qualifies. Under the provisions of the 45L New Energy Efficient Home Tax Credit builders and developers may claim a 2000 federal tax credit for each new home or dwelling unit that meets 45L energy efficiency requirements. And you could receive a 2000 per unit tax credit.

45L Tax Credits For Multifamily Dwellings. This tax credit has a reduced amount for manufactured housing of 1000. Ad Free For Simple Tax Returns Only With TurboTax Free Edition.

The Act has extended the 45L credit for qualifying units initially leased or sold through December 31 2021. 45L is a federal tax credit for energy efficient new homes. Key provisions impacting the multifamily industry include the following.

What is the 45L Tax Credit. Its ability to be applied to substantial reconstruction and rehabilitation as referenced in the Section 45Lb3 is often overlooked. The 2000 tax credit per building unit is available to developers and builders of properties that are 50 more energy-efficient than a similar property built in 2006.

If youre renovating or rehabbing a multifamily property with three-stories or feweror have previously done soyou could be eligible for the 2000unit tax credit if the improvements both. Under the provisions of the 45L New Energy Efficient Home Tax Credit builders and developers can claim a 2000 federal tax credit for each new home or dwelling unit that meets 45L energy efficiency requirements. The credit was extended by the Consolidated Appropriations Act 2021 and applies to residences sold or leased on or before December 31 2021.

Submit the contact form at the bottom of the page or call 804-225-9843 to find out how to take advantage of the 45L Tax Credit. Most eligible multi-family projects qualify for the 2000 Energy Efficient Home Tax Credit due to strict California building code. The Section 45L tax credit which rewards multifamily developers with tax credits of 2000 per energy efficient apartment unit.

This category includes manufactured housing. Through recent passage of a new tax extenders bill the energy efficient home credit the 45L credit which provides eligible contractors with a 2000 tax credit for each energy efficient dwelling unit is retroactively available for projects placed in service from 2018 to 2020 and through the end of 2021. Section 45L tax credit is a credit that offers developers a means to offset the costs associated with building energy-efficient single family or multifamily properties.

45L Energy Efficient Home Credit. Get Rid Of The Guesswork And Have Confidence Filing With Americas Leader In Taxes. The credit provides a dollar-for-dollar offset against taxes owed or paid in the tax year in which the property is sold or leased.

Taxpayers also have the ability to amend returns to claim missed tax credits from previous years. The 45L credit which previously was set to expire on December 31 2020 allows the eligible contractor of a qualified new energy-efficient dwelling unit a 2000 tax credit in the year that unit is sold or leased as a residence. With CHEERS Energy Consultants and HERS Raters can now qualify additional dwelling units ADUs multi-family apartments and condominium projects for the 45L tax credit.

If you are a developer that has built a low-rise multifamily property the 45L tax credit could benefit your company. Get Your Max Refund Today. The 45L Energy Efficient Home Credit offers builders developers a 2000 federal tax credit per energy efficient home.

The Energy Efficient Home Credit as established by the Energy Policy Act of 2005 allows eligible developers to claim a tax credit for each dwelling unit. The 45L Tax Credit originally made effective on 112006 offers 2000 per dwelling unit to developments with energy consumption levels significantly less than certain national energy standards. Recent tax legislation extended the Energy Efficient Home Credit to developers of energy-efficient homes and apartment buildings.

Section 45L Energy Efficiency Credits Low-rise three-story and below apartment developers are eligible for a 2000 tax credit for each new or rehabbed energy efficient dwelling unit that is first leased. 2000 per qualified home Single family and multi-family projects up to three stories including condos apartments assisted living and student housing can qualify.

Energy Efficiency Tax Incentives Renewed Through 2020 The Retrofit Companies Inc

The Proposed Build Back Better Act Makes Significant Changes To The 45l And 179d Energy Efficiency Tax Incentives Ics Tax Llc

2021 Available Tax Incentives For Energy Efficiency Cova Green Homes

Section 45l Tax Credit Case Study Apollo Energies Inc

Tax Benefits For Multifamily Rehabilitation Property Projects

Affordable Housing Developers Investors Additional 2 000 Tax Credit

New Energy Efficient Home Tax Credit 45l Fox Energy Specialists Texas Energy Code And Hers Rating Services

179d Tax Deductions 45l Tax Credits Source Advisors

Don T Miss Out On Potential Energy Tax Credits For Your Projects

Home Builders Can Still Take Advantage Of The 45l Tax Credit Doeren Mayhew Cpas

Section 45l Tax Incentive For The Real Estate Industry Extended Through December 2020 Tax Point Advisors

Tax Credits For Multifamily Dwellings 45l Tax Credit Engineered Tax Services

Tax Credit Extended For Home Builders Multifamily Developers Bkd

What Is The 45l Tax Credit Get 2k Per Dwelling Unit We Can Help

Tax Credits For Multifamily Dwellings 45l Tax Credit Engineered Tax Services

Tax Benefits For Multifamily Rehabilitation Property Projects

Community Developers Energy Star